Health insurance companies want you to believe that health insurance is some big, complicated, monolithic concept, but it’s really very simple.

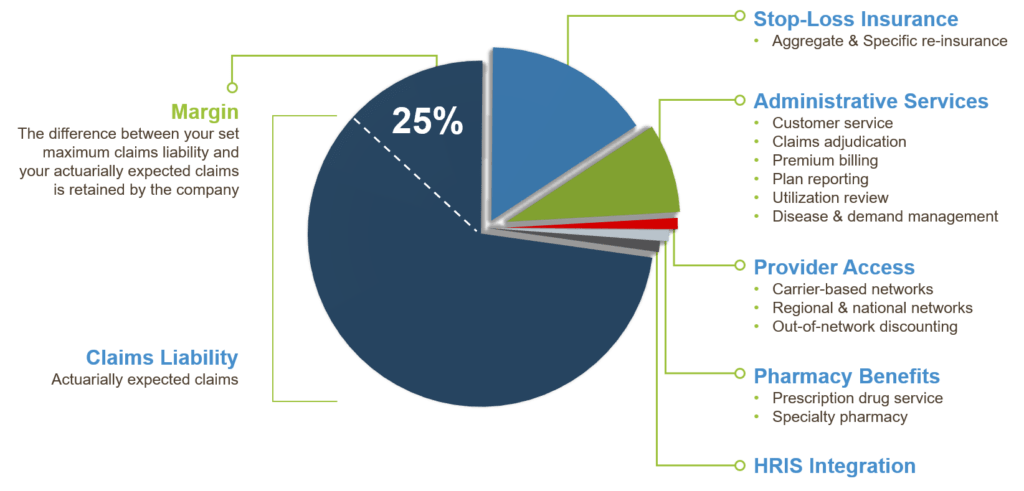

At their hearts, health insurance plans are divided into three core components: claims, administration, and reinsurance. But you wouldn’t know, because insurers present their offerings as an opaque package that makes it difficult to discern what’s in their plans. Brokers show the plans to their customers, who ultimately decide based on the bottom-line price without really knowing what they’re paying for.

If this seems like a bad way to approach handling one of the largest expenses on a company’s balance sheet, that’s because it is. What’s worse, it flies in the face of the carriers’ talk about the need for more transparency by obscuring the standard 25% margin (fluff factor) carriers build in, ensuring they always come out ahead. As you can see from the chart below, claims only make up a portion of a standard health insurance rate. Meanwhile, look at the margins imposed by the carrier:

It doesn’t have to be this way. Self-funded and partially self-funded health insurance plans, like those which EVHC provides, give employers the chance to offer their employees exceptional coverage without having to pay an egregious 25% margin. They put money back in employers’ pockets without compromising on the benefits employers have come to expect.

However, there are some key differences between these approaches. Let’s look at the fundamental distinctions between self-funded and partially self-funded insurance, and why partially self-funded health insurance is the best option for many brokers, companies, and employees.

With a self-funded health insurance plan, the employer pays for all employees’ healthcare claims, but only the eligible claims covered under the plan they file. Employers avoid carrier mark-ups and keep all unused money that has been allocated for insurance claims.

Organizations that leverage self-funded health insurance plans tend to be larger companies. After all, it’s much easier to predict the health insurance patterns of tens of thousands of employees rather than a few hundred, simply because there’s a larger sample size.

What is level-funded health insurance?

Level-funded insurance plans are a form of self-funded insurance. Like self-funded insurance, employers agree to a set pot of money upfront from which all claims are paid. However, many carriers that offer level-funded insurance plans inflate administration costs by up to 40% and ask their customers to split 50% of their unused funds with the carrier. To put it in Vegas terms, the house—in this case, the carrier—always wins.

Partially self-funded health insurance is also like totally self-funded, with one key difference: partially self-funded plans use a reinsurance carrier through an administrator behind the scenes. This helps limit risk and stop-loss. Organizations still only pay claims as they come in, and any unused funds never leave their corporate accounts.

Partially self-funded insurance plans offer many benefits, particularly for smaller or medium-size organizations where claims are more unpredictable. In addition to eliminating the need to pay for more insurance than is necessary, EVHC’s partially self-funded plans offer:

EVHC’s partially self-funded plans provide these benefits while allowing organizations to pay only for the claims their employees submit. The amount of money paid out is capped at a pre-determined stop-loss threshold, so companies never overpay for insurance. That alone is a great selling point for brokers and a key incentive for employers looking to save money on health insurance.

Every year, brokers present customers with menus of options, and clients proceed to spend millions of dollars on a plan without any real idea of how their employees are using that plan. They also don’t know how much money they’re overspending for healthcare they don’t need. It’s a transactional, painful ritual for everyone involved.

But healthcare should never be purely transactional. It must be rooted in what’s best for the company and its employees.

Increasingly, what’s best is the option that provides organizations with greater flexibility, control, and cost savings, while still offering great benefits. That option is partially self-funded insurance.

To learn more about EVHC’s partially self-funded options, read about our health insurance plans and contact us for more information.