The highest court in the U.S. recently issued a healthcare-related decision that will significantly impact premiums for many people.

On June 21, the Supreme Court ruled 7-2 in favor of Marietta Memorial Hospital, rejecting a claim by the dialysis provider DaVita that the hospital’s self-insured health plan’s low reimbursement rates violated the Medicare Secondary Payer Act (MSPA). The Court decided that members are not being discriminated against and that self-insured providers can reimburse at the Medicare level without violating the MSPA.

As noted by SHRM, “the MSPA requires private health plans that cover dialysis to be the primary payer of those treatments for at least 30 months after a patient is diagnosed with kidney failure, with Medicare as a secondary payer for Medicare-enrolled patients.” DaVita argued that the hospital’s plan encouraged dialysis patients to drop employer-sponsored healthcare coverage in favor of Medicare. But the Court effectively said that Marietta Memorial had the right to limit payments because the plan did not discriminate between patients eligible for Medicare and those not.

The ruling spotlighted the cost of dialysis treatment, which is prohibitively expensive for many individuals, largely due to how fully insured providers operate. A study by JAMA Internal Medicine found that spending on dialysis care is three times higher for patients in the individual market as opposed to those receiving treatment through Medicare. Indeed, dialysis care costs some members more than $14,000 per month.

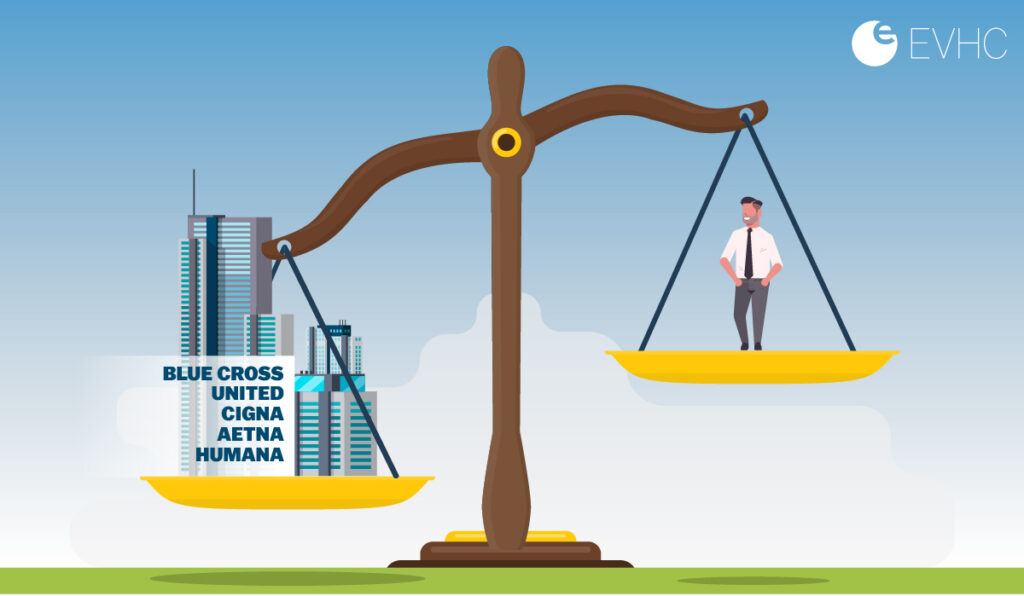

Unfortunately, those patients are beholden to what their fully insured carrier covers. The carriers know these people need their treatments.

But as the Court correctly found, there are flaws in this business model. Patients and their employers don’t just need to pay whatever their fully insured providers dictate. They have other and more affordable options.

That’s because dialysis treatment doesn’t necessarily cost thousands of dollars per month. Those high numbers are the result of the surcharge imposed by fully insured providers.

For instance, Medicare might charge $100 for treatment, but a private fully insured provider may charge 20 times that amount. Thus, that $100 becomes $2,000. For a patient experiencing end-stage renal failure, that could mean hundreds of thousands of dollars every year in out-of-pocket expenses.

The Court’s decision supports self-funded plans’ ability to carve out dialysis benefits and set appropriate rates for all members. The decision is a boon to self-funded insurance and reinforces the fact that self-funded providers like EVHC can take steps to control costs around dialysis care by setting reasonable and affordable premiums.

Essentially, the Court’s ruling makes clear that the only way for employers and employees to effectively save money on dialysis treatment and keep it affordable is through self-funded insurance. With self-funded insurance, employers and employees only pay for the actual claim amount. There’s no hidden upcharge or outrageous margin imposed as they would be by a fully insured provider.

At EVHC, we also limit the amount of auto-adjudication on the claims we process. Only about 65% of the claims we manage are auto-adjudicated. Instead, we closely examine complex cases—which dialysis treatments often are—and look for ways to save money for our clients.

The Supreme Court ruling is exclusively focused on dialysis, but could this set a precedent for future rulings regarding other healthcare treatments? Perhaps. It’s simply too early to say. After all, there are a lot of complex and necessary treatments out there.

But—it’s not too early to say that self-funded insurance is the best option for companies with employees relying on dialysis treatments. That has been clear for some time; the Supreme Court merely confirmed it.