Recently PriceWaterhouseCoopers predicted healthcare costs will rise 6.5% in 2022, and no doubt insurance premiums will go up, too. On the surface, that makes sense—after all, insurers base their premium rates on the actual cost of care, right?

Not quite.

While it’s true that insurers do use medical cost projections to establish their rates for the forthcoming year, those actual costs are just a fraction of the calculation. There are hidden fees embedded in the premiums employers and employees pay every year and month. Those fees add up to a lot of extra money that employers would otherwise be able to keep in their bank accounts. Meanwhile, insurers manage to stay well within the black until the next year—when they will inevitably raise premiums again.

Here’s how it works:

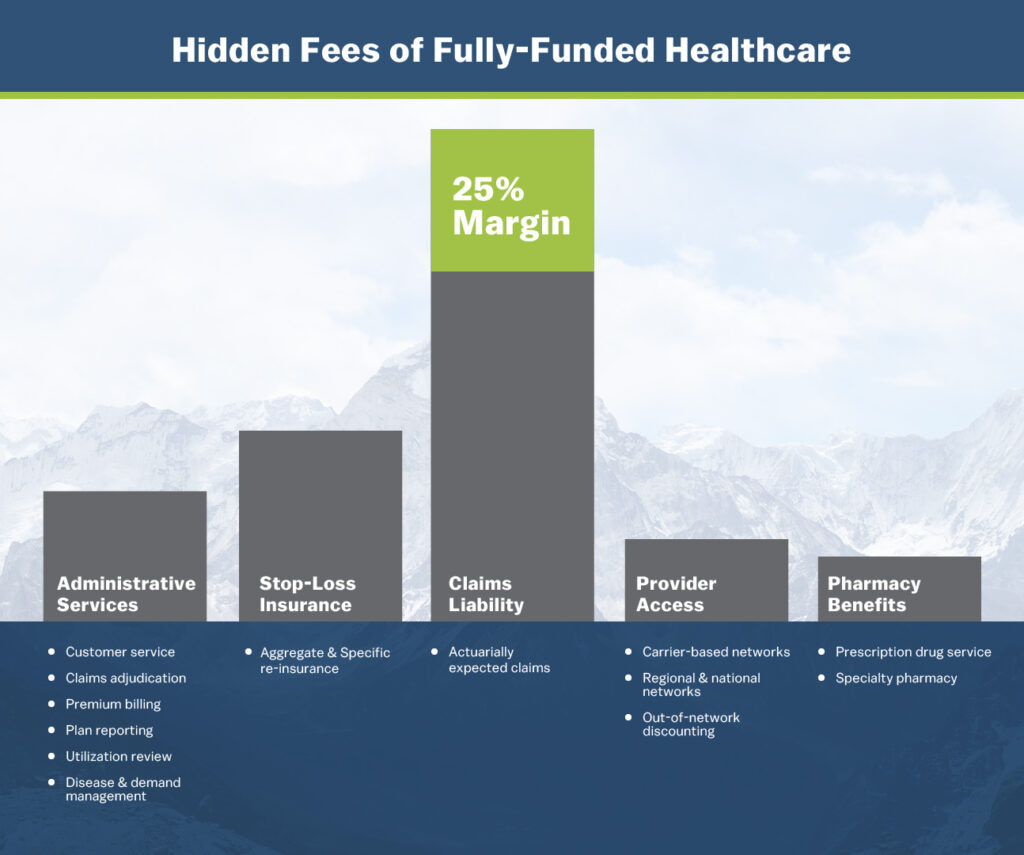

Administrative Services, Stop-loss Insurance, Provider Access, and Pharmacy Benefits make up about 17 to 30% of an employer’s monthly health insurance premium. Claims Liability comprises about 45 to 58% of the premium, give or take. That all sounds about right.

But what’s that green box on top of Claims Liability? That’s the margin that every fully insured carrier imposes upon their customers. It typically takes up about 25% of the monthly premium—and it’s the hidden fee that insurers do not want their customers to know about.

Where Claims Liability covers the expected number of claims a company may incur and their associated costs, the margin essentially serves as a buffer in case claims exceed their expectations. The problem for employers is they end up paying those margins anyway, even if their claims fall under or at the expected levels. As a result, they often end up spending more than necessary.

If you’re an insurer, this is like playing with house money in Vegas. There’s no way you can lose! But how is that fair to a company that may already be struggling to manage costs in the wake of the pandemic, or for a smaller organization that is simply trying to both stay in business and do right by their employees?

There’s an old adage that “you get what you pay for,” but that’s not necessarily true, at least in health insurance circles. Many employers are paying fully insured carriers a lot of money to handle their claims, but that doesn’t mean they’re doing a good job handling them. As such, employers should not only be concerned about where their money is going, but what they’re getting for their money. Unfortunately, all too often they’re not getting what they’re paying for.

For instance, most fully insured providers deal with thousands of claims every day. There’s no way for them to manually comb through each of those claims, so they end up auto adjudicating them, quickly approving or denying them without very much analysis. This can end up costing employers and employees more money, creating unhappy customers. No wonder “claims handling” tops the list of complaints people have about their health insurance companies.

Then, there’s the time it takes to handle insurance claims—not on the part of the insurer, but the employer. One would think that paying thousands of dollars per month would warrant white glove-style service, but that’s not always true. We’ve worked with a number of employers who have told us horror stories of spending hours on the phone with their previous insurance providers’ customer service teams trying to get to the bottom of one issue or another. Instead of their carriers working for them, they were the ones doing the legwork to ensure their employees received the benefits they deserved. They spent valuable time tracking down claims that could have otherwise been devoted to growing their businesses.

At EVHC, we’ve done what fully insured health insurance providers have promised, yet failed, to do: made health insurance truly transparent. Our employer customers know what they’re paying for and only pay for the claims they incur. With our partially self-funded insurance plans, there are no hidden fees, nothing up our sleeves. Employers pay only for their claims and get to keep the rest of the money they’ve allocated for health insurance, just as it should be.

We also do not believe in letting our customers do the work—that’s our responsibility. As such, we are committed to providing employers with exceptional 24/7 customer service and treat every claim with the attention it deserves. Whereas fully insured carriers typically auto adjudicate 90% of the claims they receive, we limit our auto adjudication to around 65% and spend the rest of the time pouring over more complex claims. We also build customized plans for our customers from scratch, tailoring them to meet their unique needs. We complement those plans with access to the country’s most robust PPO networks and easy-to-use tools, including mobile applications and online chatbots, so employers and employees can have fast access to information and receive answers to their questions whenever they need.

In any other industry, the practice of imposing hidden fees would be considered shady business. Sadly, it’s become an accepted practice in the health insurance field. Part of the reason is probably because most employers don’t even realize they’re paying these fees, so they just continue to pay them.

At EVHC, we feel it’s important to shine a light on these hidden fees and let employers know they actually don’t have to be locked into paying these additional costs. Partially self-funded insurance is a cost-effective alternative that allows them to provide their employees with excellent healthcare coverage while keeping their profits in-house where they belong.

BACK TO INSIGHTS